First Ever Leveraged Sui-linked ETF

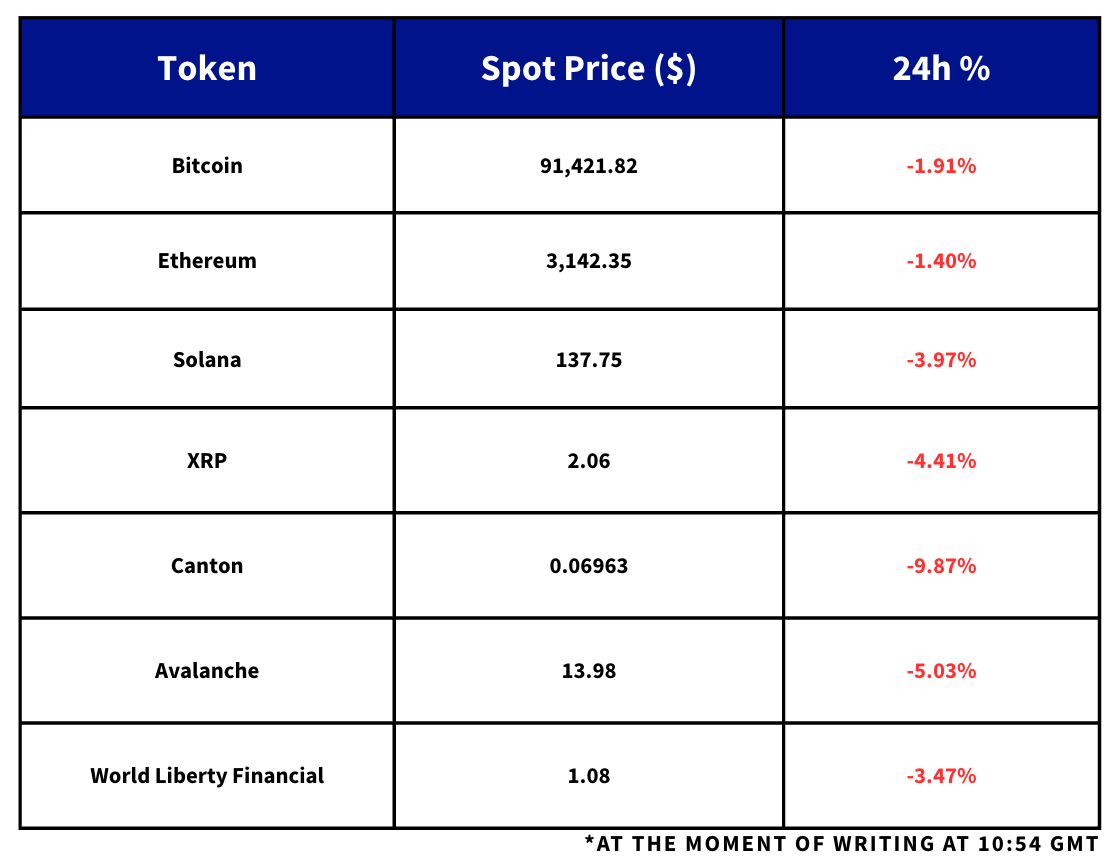

BTC stalled after an intraday spike to $94k and now trades just above $91k, with ETH slipping from $3,200 to $3,100 as short-dated OTM put premia compressed from 11 to 5 vols over calls in BTC and to ~2.5 vols in ETH, even as ETH is only +4% over five days despite BitMine nearing 5% of supply and the Fusaka upgrade going live. Spot flows remain a headwind: spot ETH ETFs have taken in just $9.8m net so far this week, while spot BTC ETFs have seen $142.5m of outflows including a $194.6m single-day bleed, the largest since 20 November. Structurally, 21Shares secured approval to list the first US Sui-linked leveraged product, the 2x SUI ETF (TXXS), taking the crypto ETF tally to 74 for 2025 and 128 overall, while Base launched a Chainlink-CCIP bridge to Solana to move SOL/SPL and Base-native assets cross-chain.

Find out our latest reports, listed below:

Market Snapshot: Overnight Moves

Daily Updates:

- Both the rally in BTC and US equities slowed down in yesterday’s trading session. BTC reached an intraday high of $94K, though currently trades above $91K. Similarly, ETH traded at an intraday peak of $3,200, though has now fallen to $3,100.

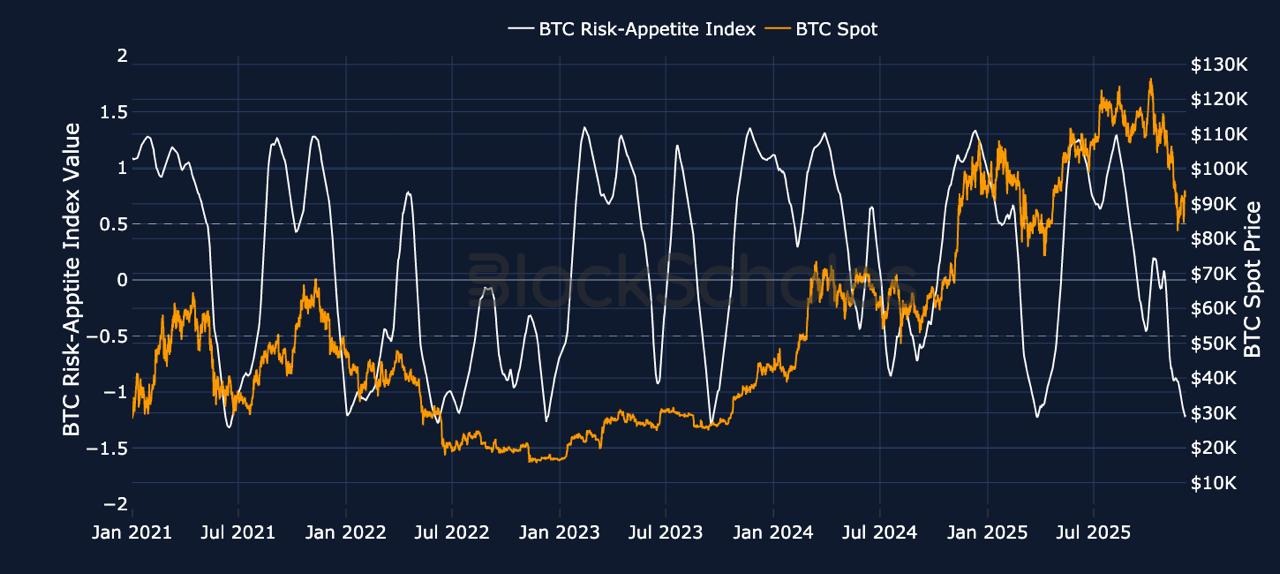

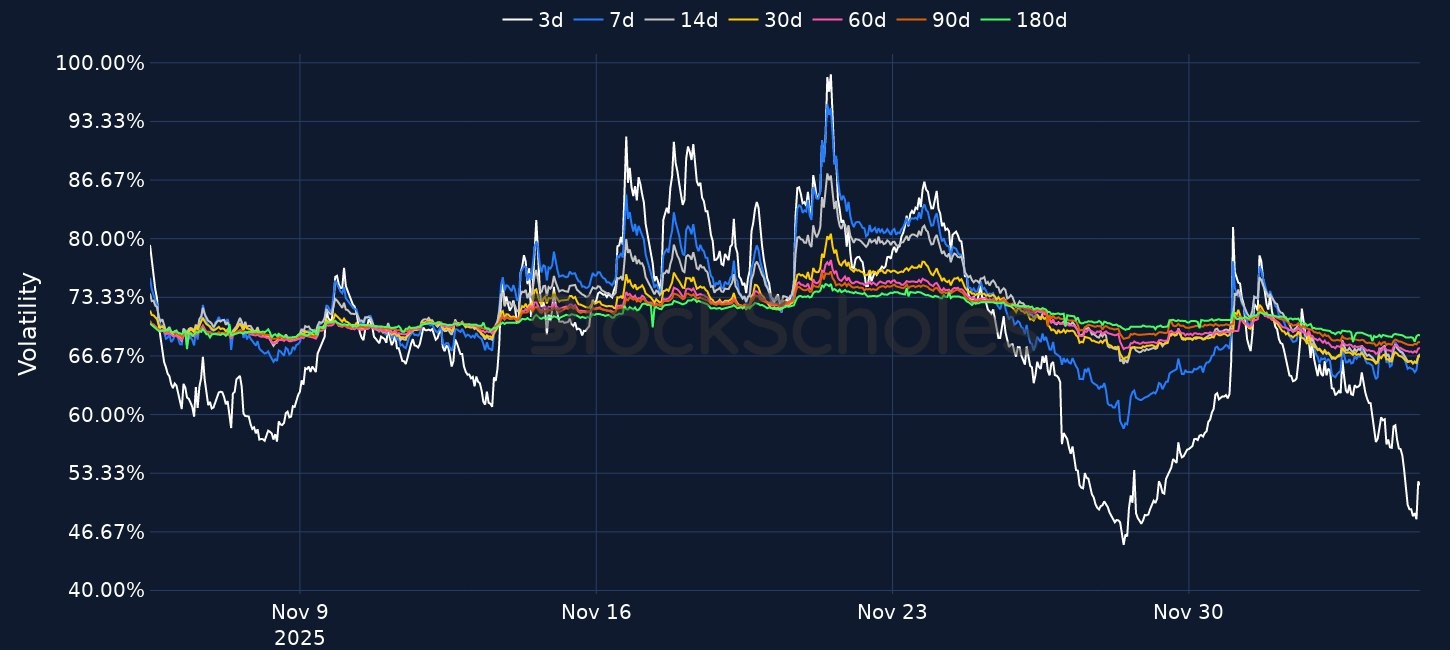

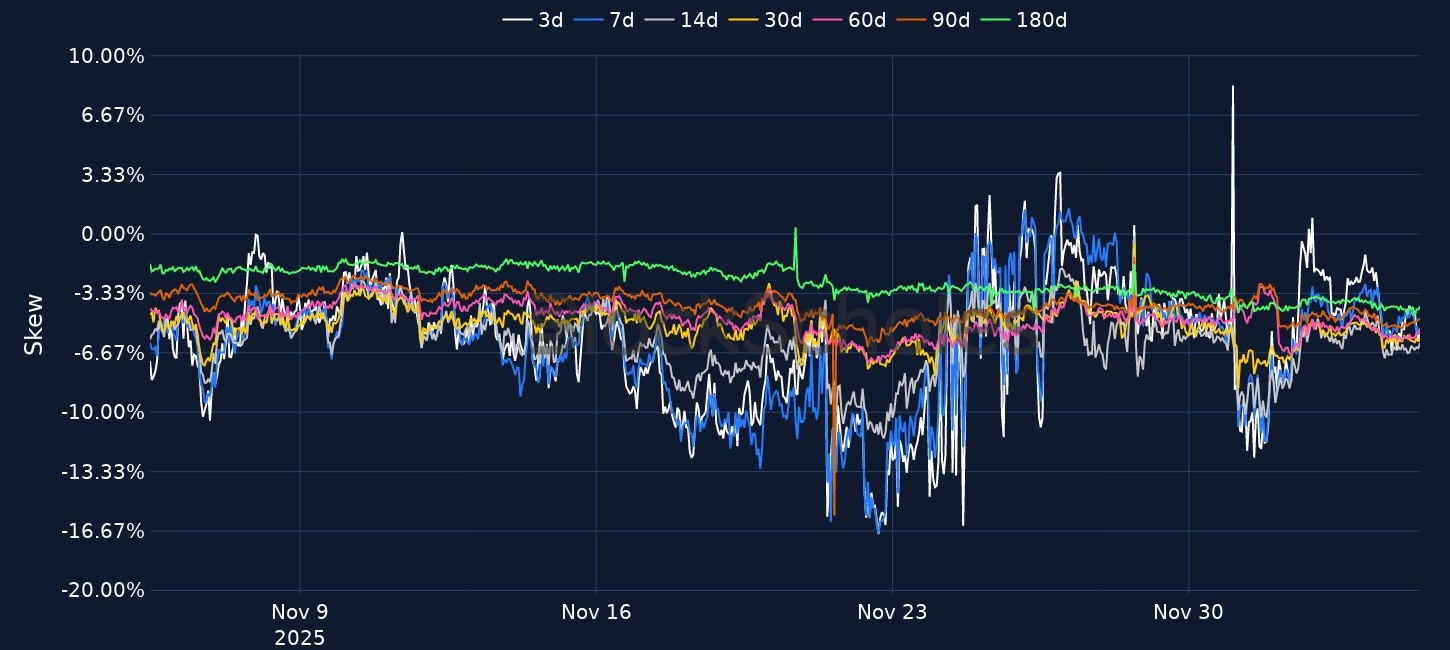

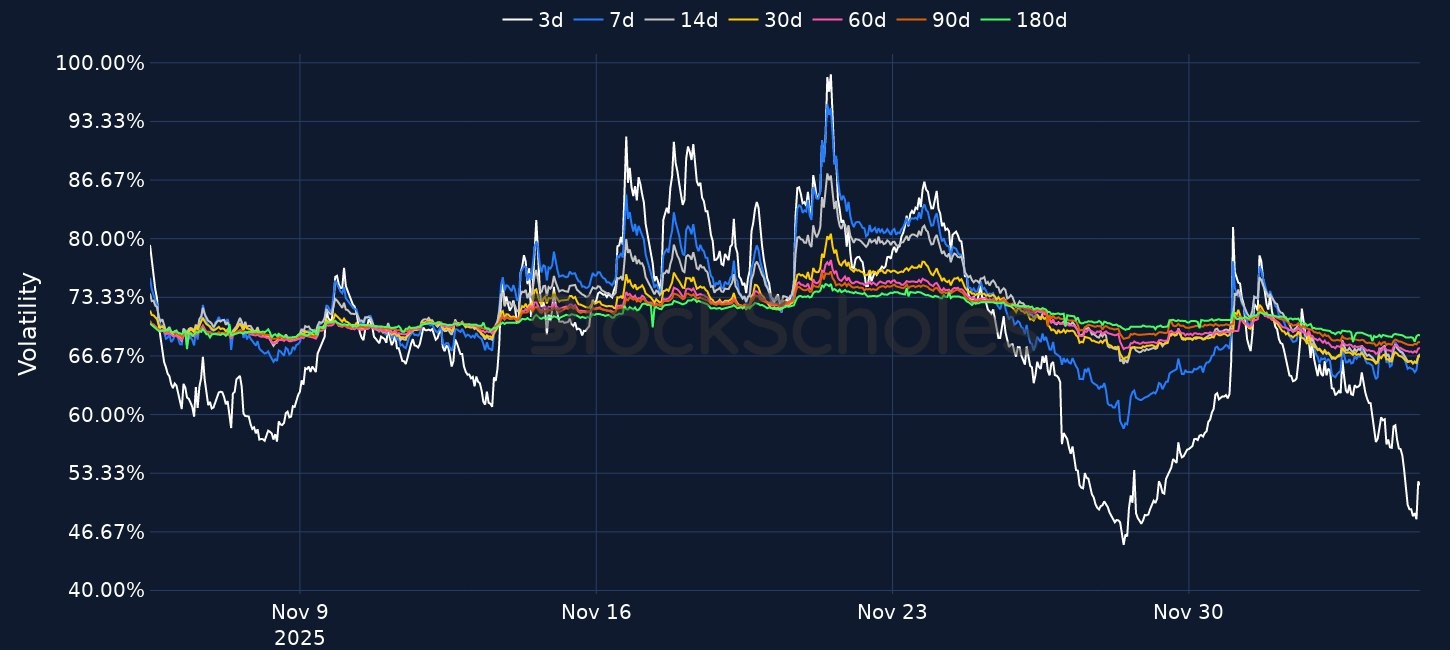

- Options markets for both assets have priced out much of their bearish skew towards put options since the start of the month, though aren’t willing to bet too definitively on a year-end rally just yet.

- The volatility premium assigned to short-tenor, out-the-money puts has compressed from 11% on Dec 1, 2025 to 5% above calls — still bearish, but not as extreme as during the worst of the sell-off.

- ETH’s vol smiles are less bearish — OTM puts trade with only a 2.5 vol point premium compared to puts.

- ETH’s spot price is only up 4% over the past 5 days, though that masks some of the recent bullish tailwind drivers for the asset: BitMine, the largest ETH DAT is getting closer towards its goal of holding 5% of Ether’s total supply, while the Fusaka upgrade went live on mainnet earlier this week. Read more about these here.

- However, one of the main drivers of ETH’s summer-2025 outperformance, Spot Ethereum ETFs, are still struggling to maintain a consistent positive inflow — so far this week, they’ve seen a meager net flow of $9.8M (three days of outflows and one inflow day).

- Equally, Spot BTC ETFs have struggled this week with cumulative outflows of $142.5M. Yesterday, the funds sold $194.6M of bitcoins, which marked the largest single-day outflow since Nov 20, 2025.

- The US stock market also only rallied modestly, with the S&P 500 Index closing 0.11% higher. That nonetheless brings the index within inches of its all-time high.

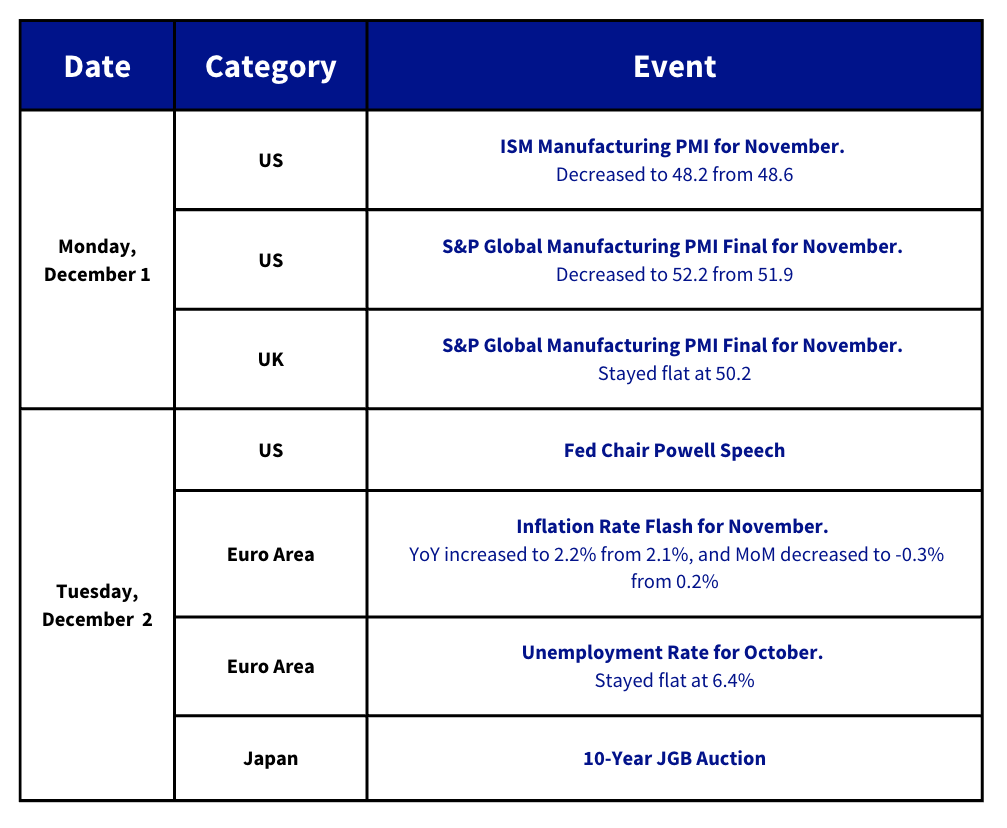

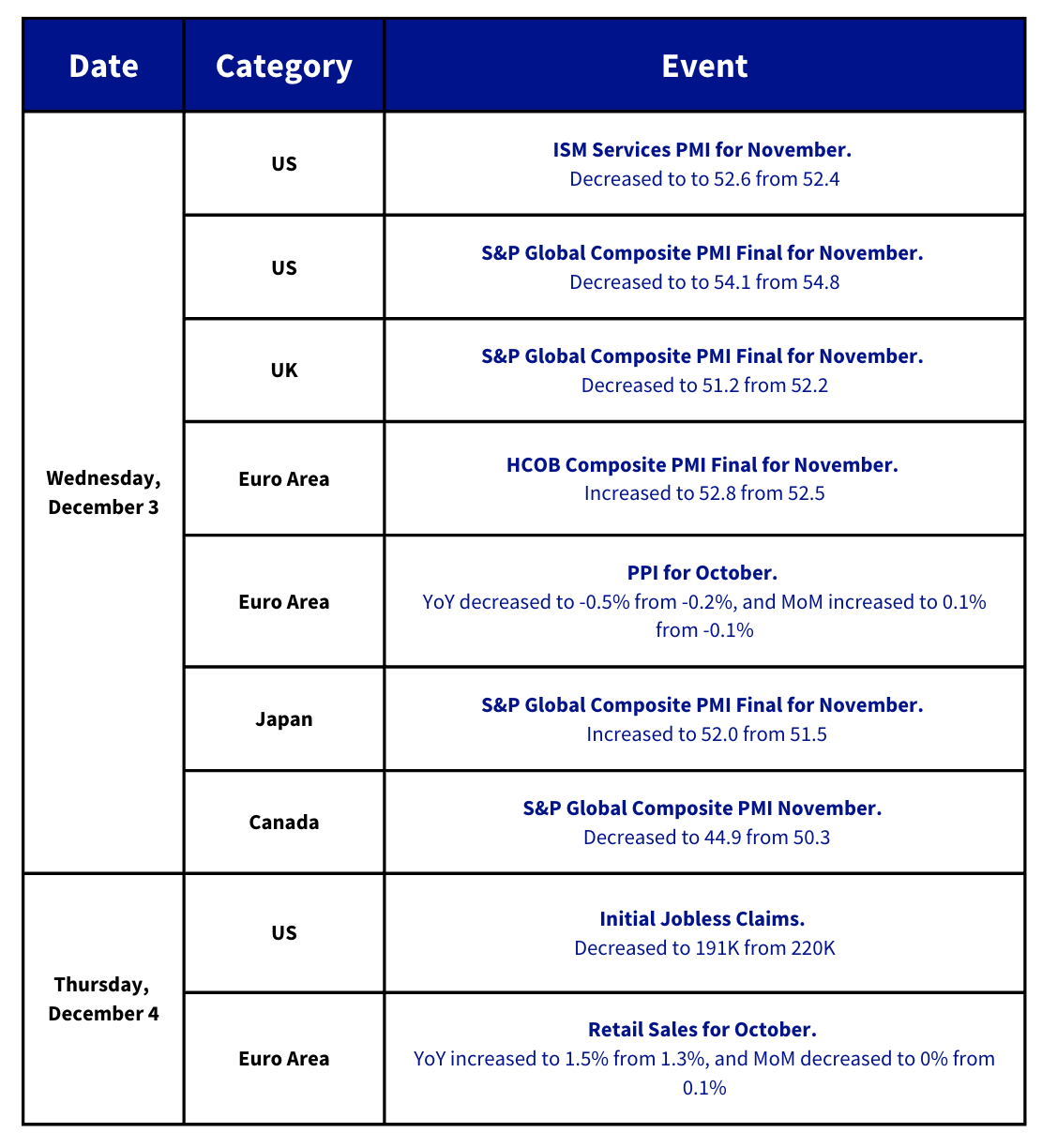

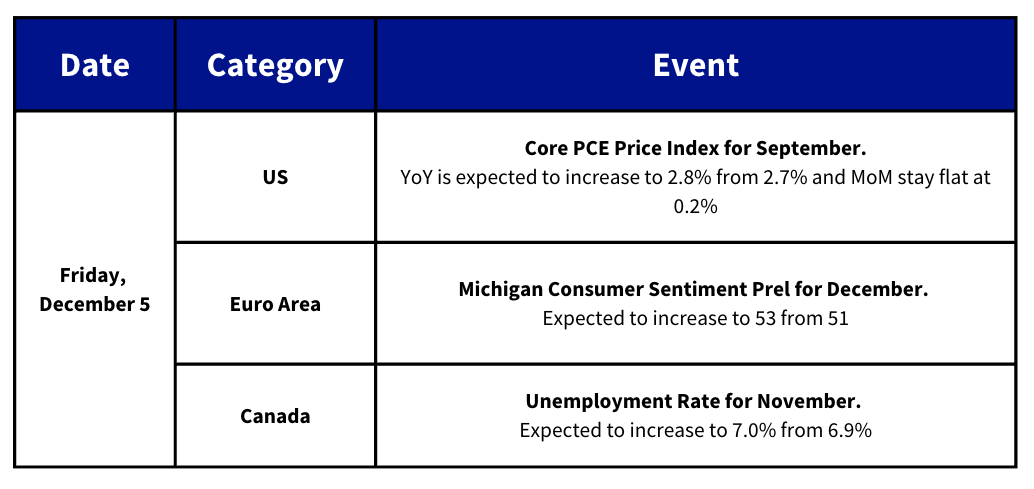

- Markets are still pricing a high probability of a December rate cut reduction by the Fed in its meeting next week, despite a stronger-than-expected jobless claims report yesterday.

- Applications for US unemployment benefits fell last week to their lowest since September 2022.

- Initial claims fell by 27,000 to 191,000 in the week ended Nov, 29 — though according to Bloomberg the data can be volatile around holiday periods, such as Thanksgiving.

- Furthermore, the 4-week moving average of new unemployment applications fell to 214,750, the lowest reading since January 2025.

- US treasuries reacted slightly stronger to the release — the 10Y yield ended the day up 4bps to 4.10%.

- Kevin Hassett, the current National Economic Council Director and market-implied front-runner for the chairman at the Fed, said in an interview with Fox News yesterday “I think we should, and I think that we are likely to”, when asked about a rate cut next week.

- He also claimed that he wanted to “get to a much lower rate” in the long-term and “If there’s consensus around 25 basis points, which it looks like there is, then I’ll take it”.

- When asked about President Trump, Hassett responded “The president has a number of candidates that he’s been thinking about … I’m honored to be on a list with some great people. And we’ll see how it goes.”

- On 4 December 2025, Switzerland-based issuer 21Shares won approval to list the first US Sui-linked ETF, the 21Shares 2x SUI ETF (ticker TXXS) on Nasdaq, offering investors twice the daily performance of the SUI token via a leveraged structure.

- Bloomberg’s Eric Balchunas flagged how unusual it is for Sui’s debut ETF to be a leveraged product, noting that TXXS is already the 74th crypto ETF of the year and 128th overall.

- Base, Coinbase’s Ethereum L2, has launched Chainlink CCIP-powered bridge to Solana, letting SOL and other SPL tokens flow into Base apps and Base-native assets move the other way, with messages independently verified by Coinbase and Chainlink node operators for added bridge security.

- Framed as a step toward making Base a multi-chain “everything economy” hub, the launch turns Base into a direct liquidity conduit between Ethereum L2 and Solana.

This Week’s Calendar:

Charts of the Day: