Altcoins Analytics 16th February 2026

This week's edition of our Crypto Altcoins Analytics.

BTC and Altcoin Dominance

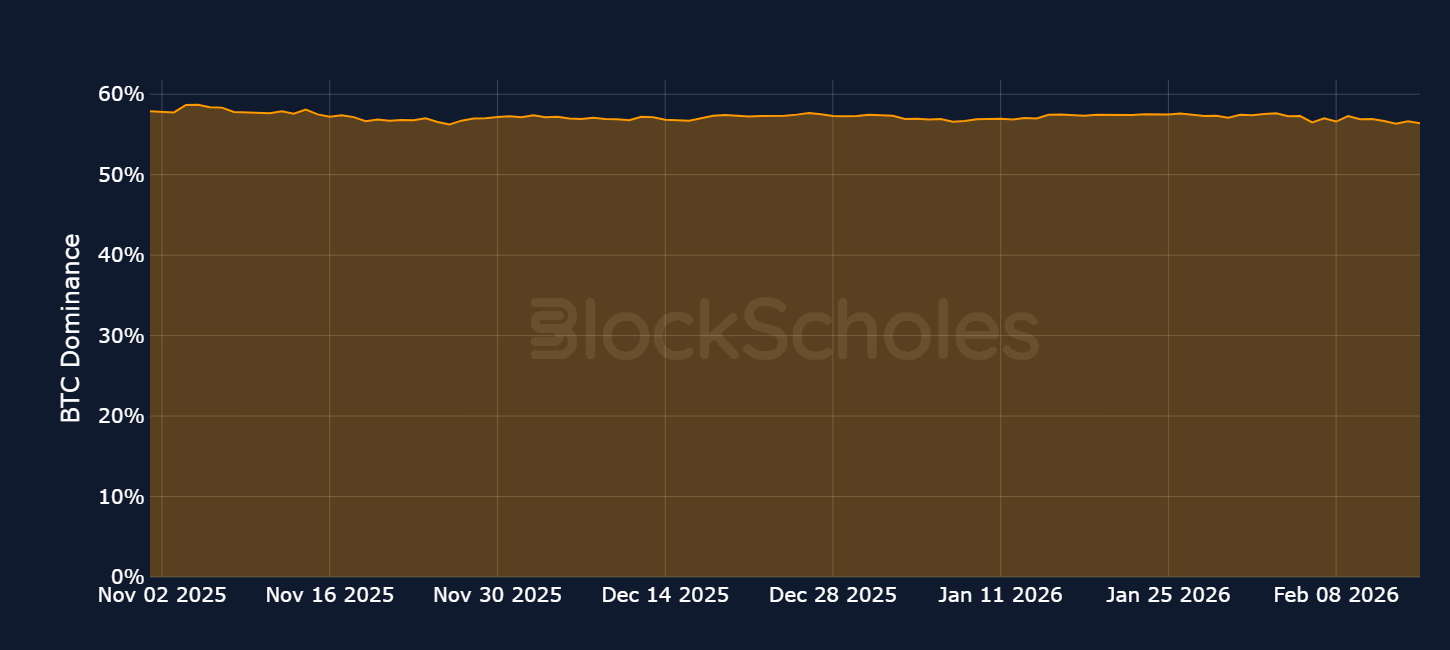

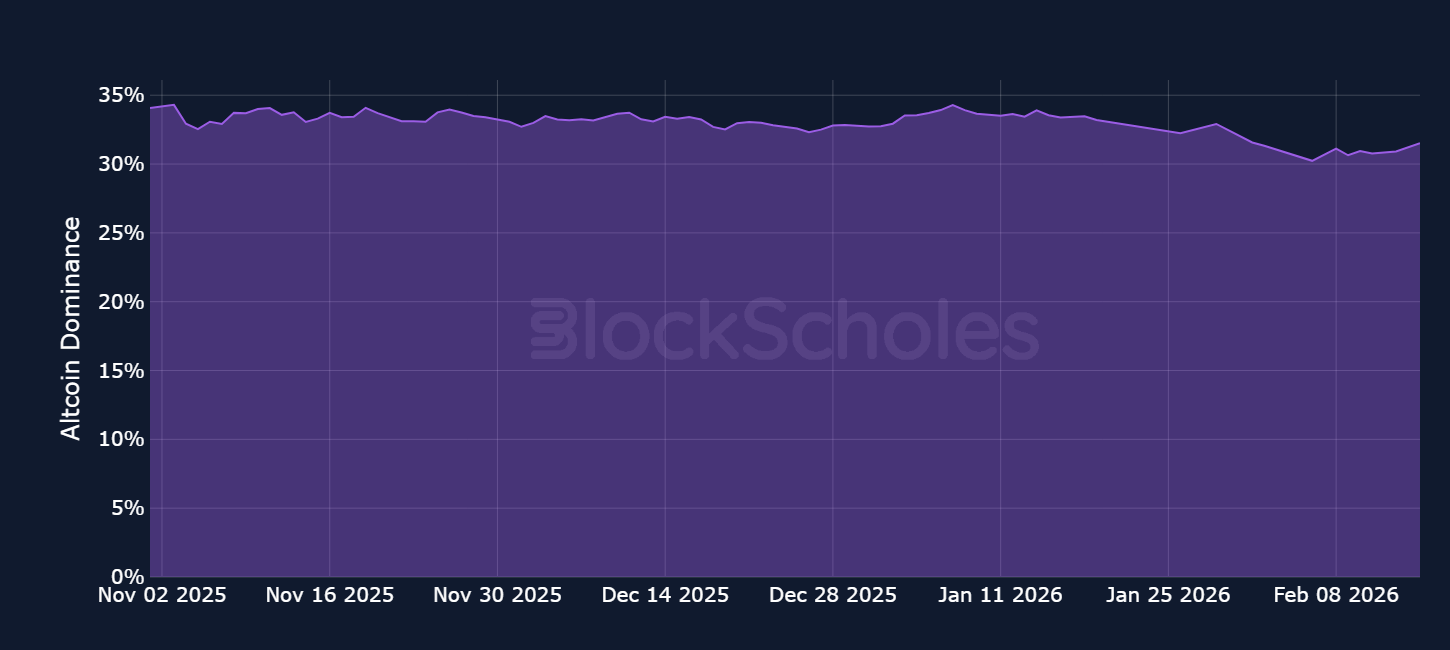

Bitcoin and Altcoin Dominance – As spot prices stabilised this week, altcoin dominance regained nearly 1.5% of the total crypto market cap following its low during the market crash earlier this month. In comparison, Bitcoin dominance has remained steadier, fluctuating between 56% and 58% year to date.

BTC Dominance

Altcoin Dominance

Altcoins / BTC Spot Crosses

Altcoin spot prices denominated in BTC: BNB

Altcoin spot prices denominated in BTC: SOL

Altcoin spot prices denominated in BTC: XRP

Altcoin spot prices denominated in BTC: ETH

Altcoins Outperformance vs BTC

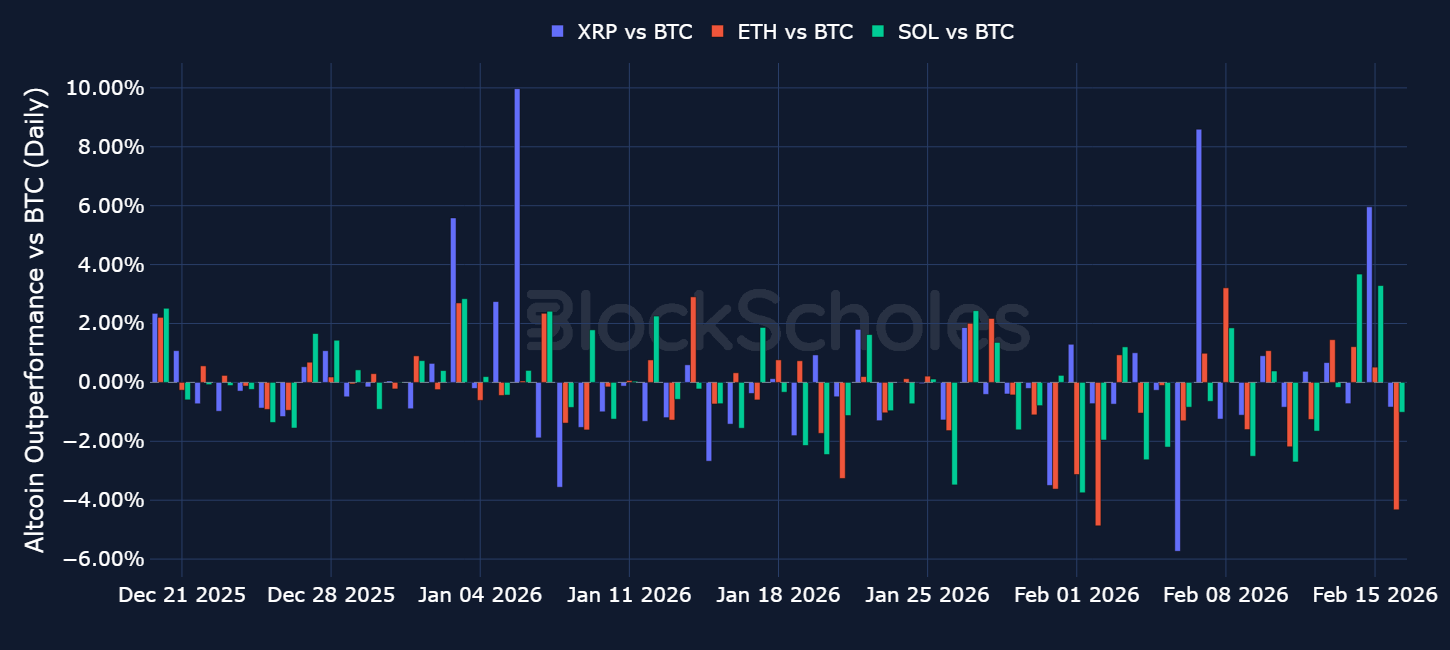

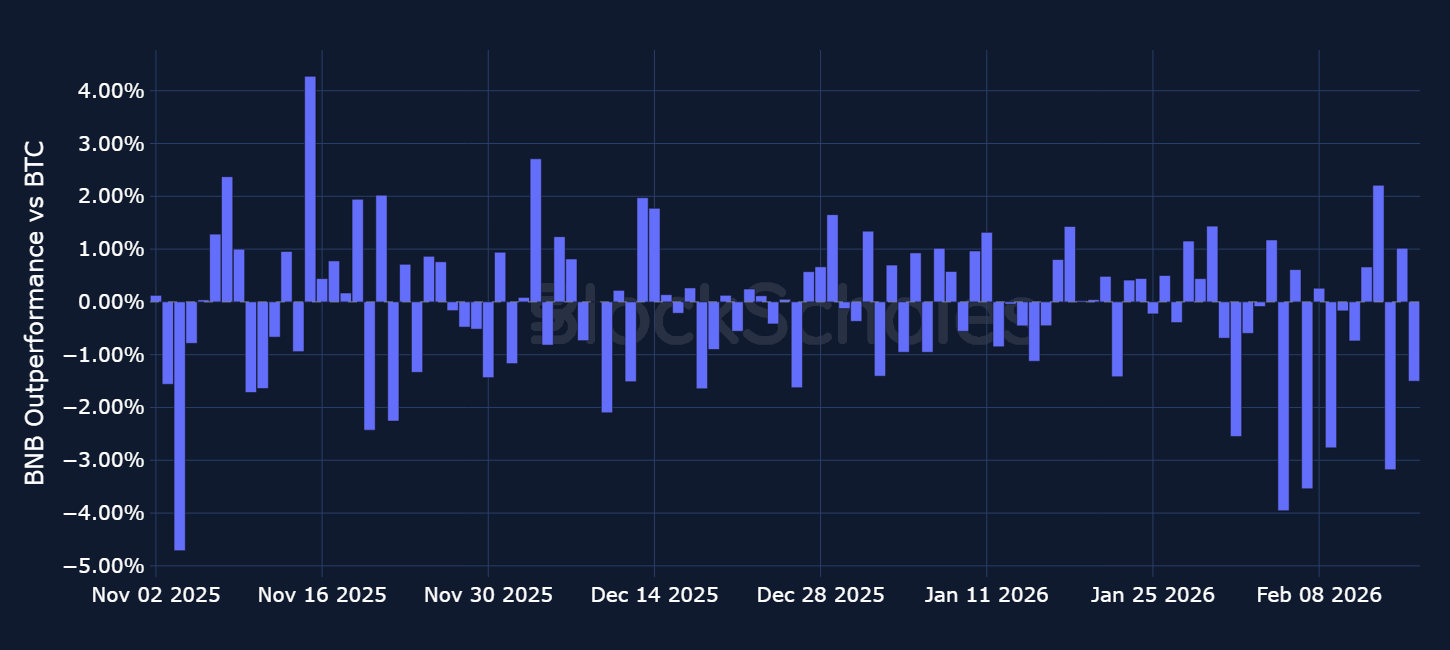

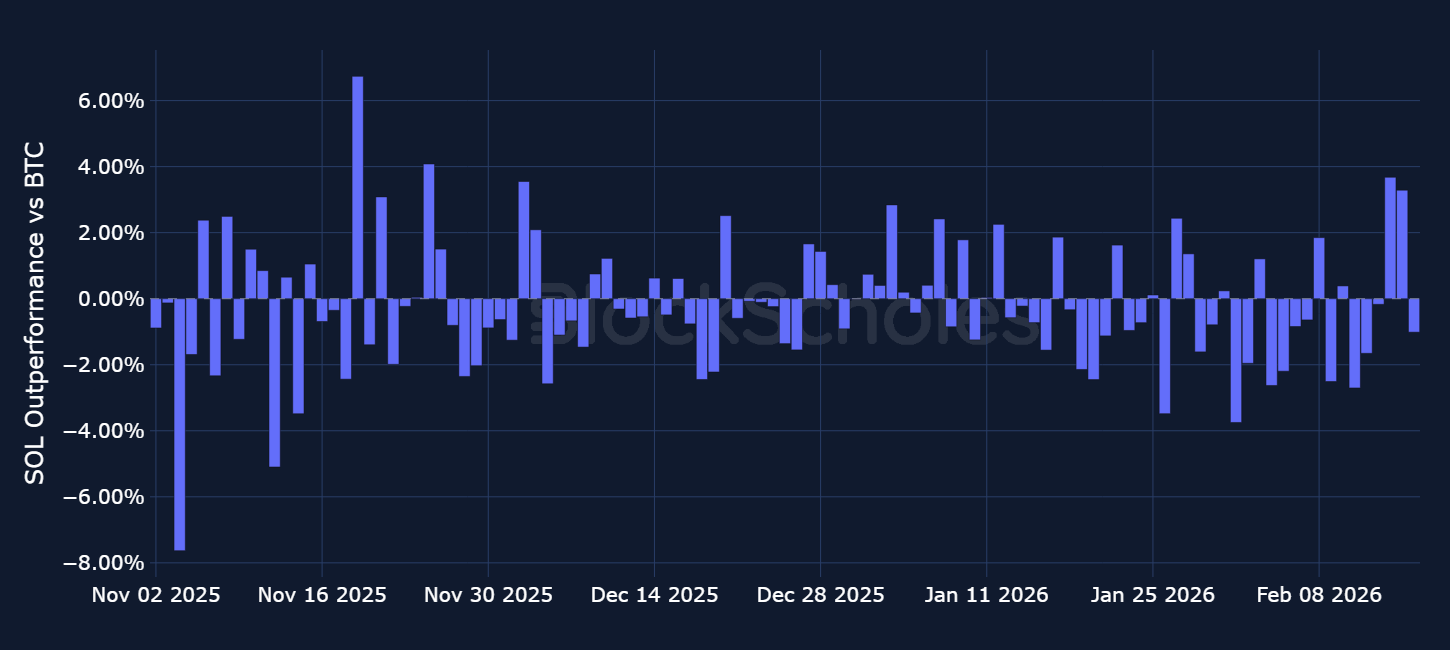

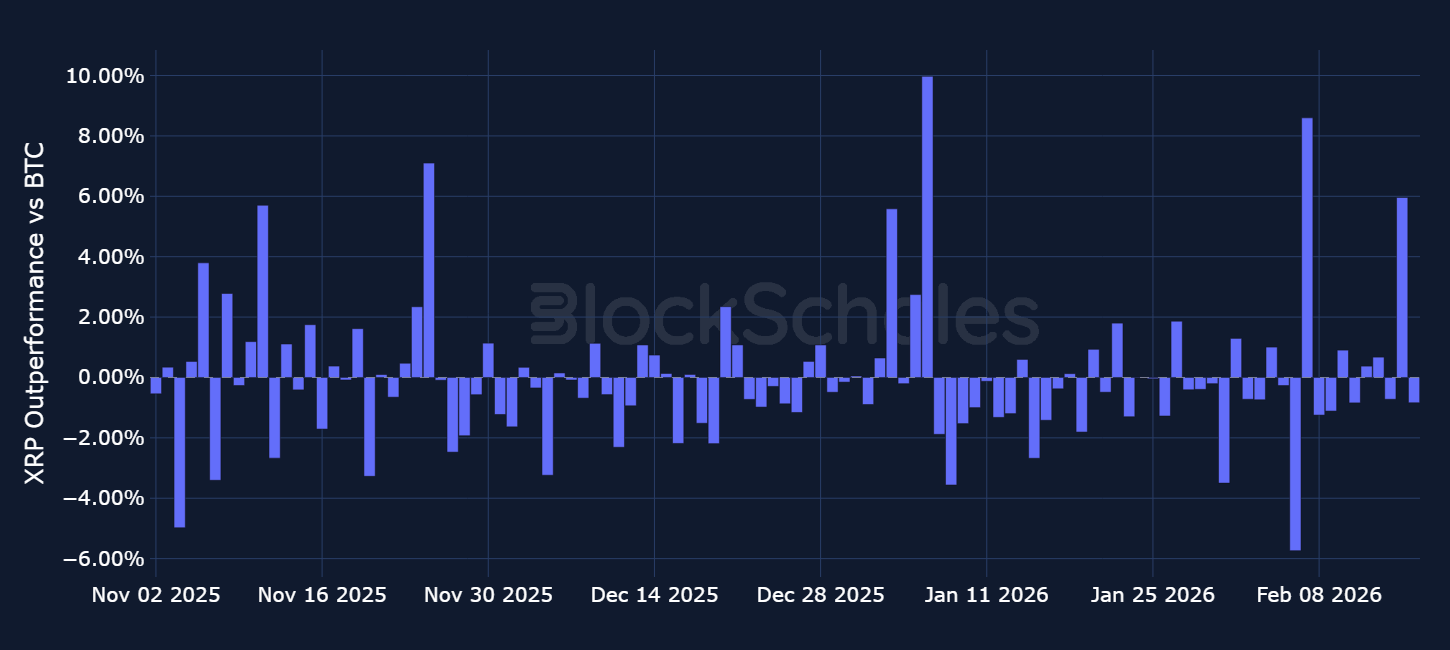

Altcoins Outperformance – ETH underperformed BTC by 5% on Feb. 16. In comparison, XRP and SOL both outperformed: SOL rose 3.6% and 3.2% relative to BTC on consecutive days following earlier-week underperformance, while XRP saw a one-day 5.9% outperformance relative to BTC and otherwise moved more in line with BTC returns for the rest of the week.

Daily relative simple returns vs BTC

Altcoin Performance vs BTC

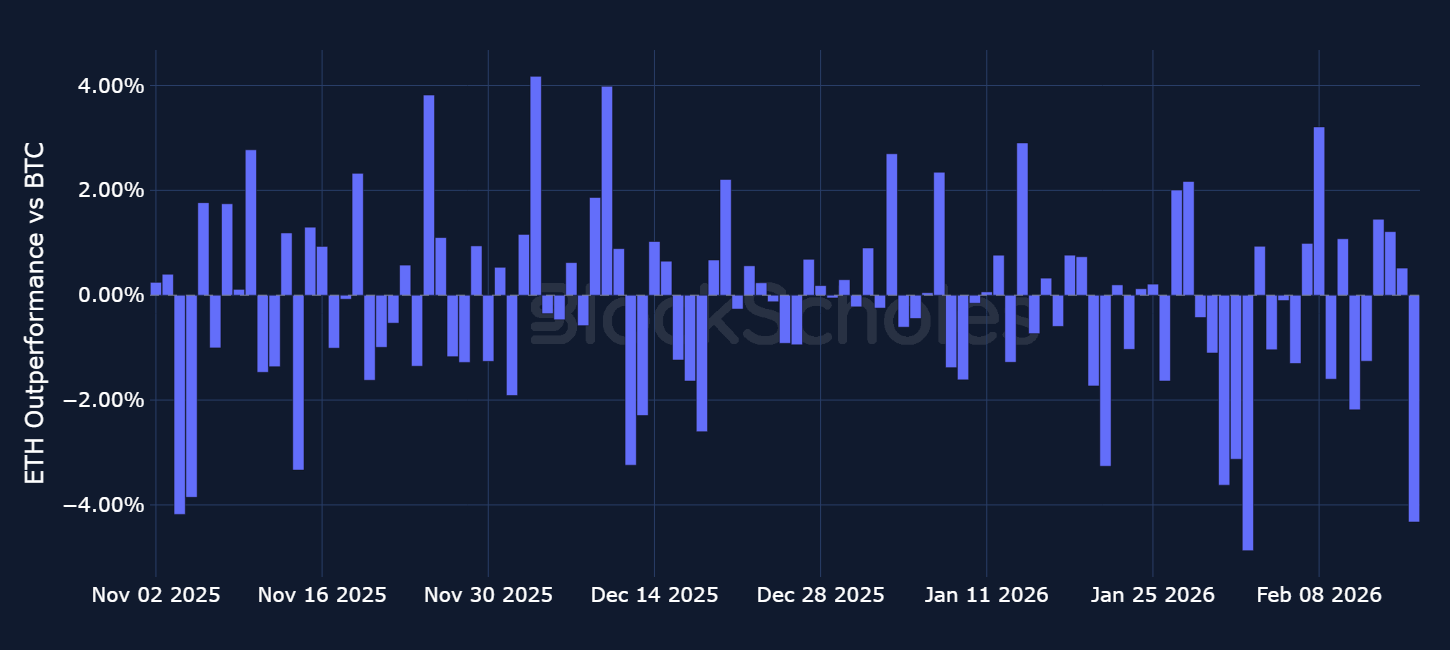

Daily relative simple returns vs BTC: ETH

Daily relative simple returns vs BTC: BNB

Daily relative simple returns vs BTC: SOL

Daily relative simple returns vs BTC: XRP

ETF Flows: BTC, ETH & Altcoins

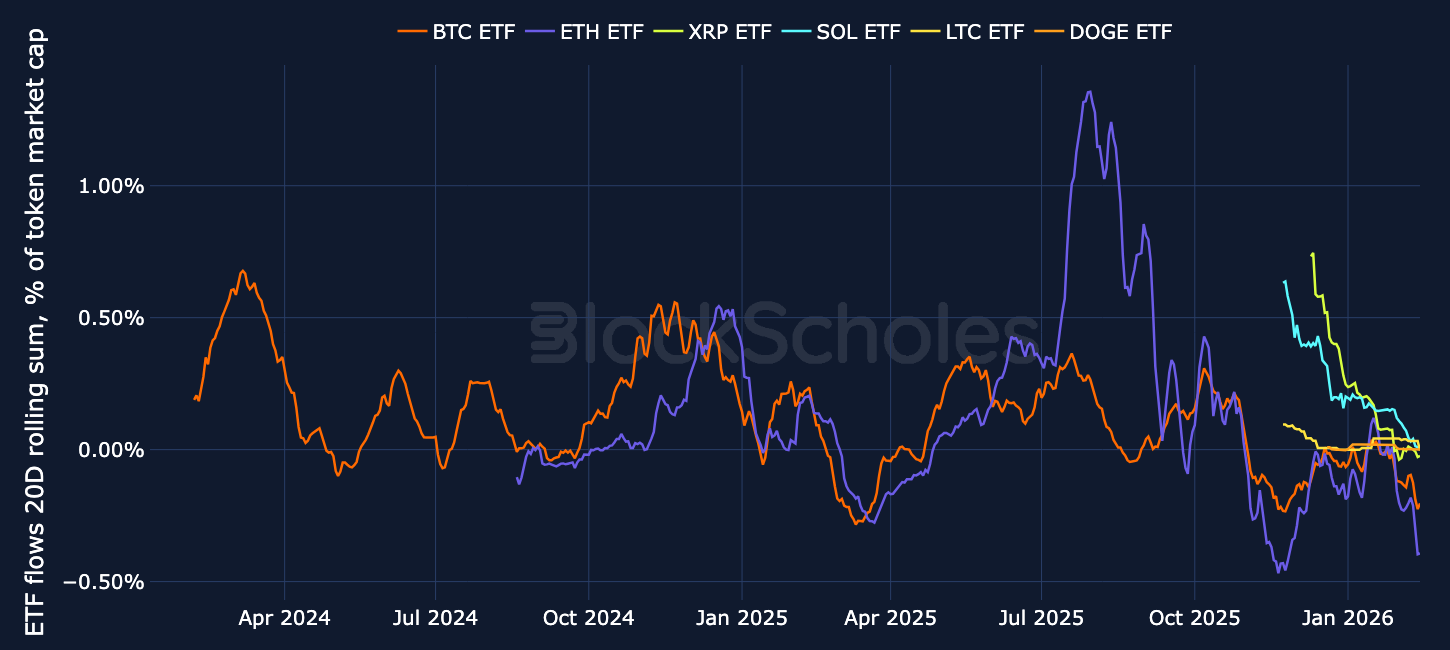

ETF Flows – BTC ETFs recorded $359.9M of net outflows, while ETH ETFs saw roughly $161.2M of net outflows.

Activity in altcoin ETFs was largely muted, with flows being close to zero for the past few days.

The only notable change occurred in SOL ETFs on Friday of $1.57M. The inflow followed the announcement that Solana Company (NASDAQ: HSDT), in partnership with Anchorage Digital and the Solana lending protocol Kamino, launched a structure allowing institutions to obtain loans secured by natively staked SOL while the assets remain staked and held in segregated custody accounts at Anchorage.

ETF net Flows: BTC, ETH & Altcoins

Regression-Based Valuation vs BTC

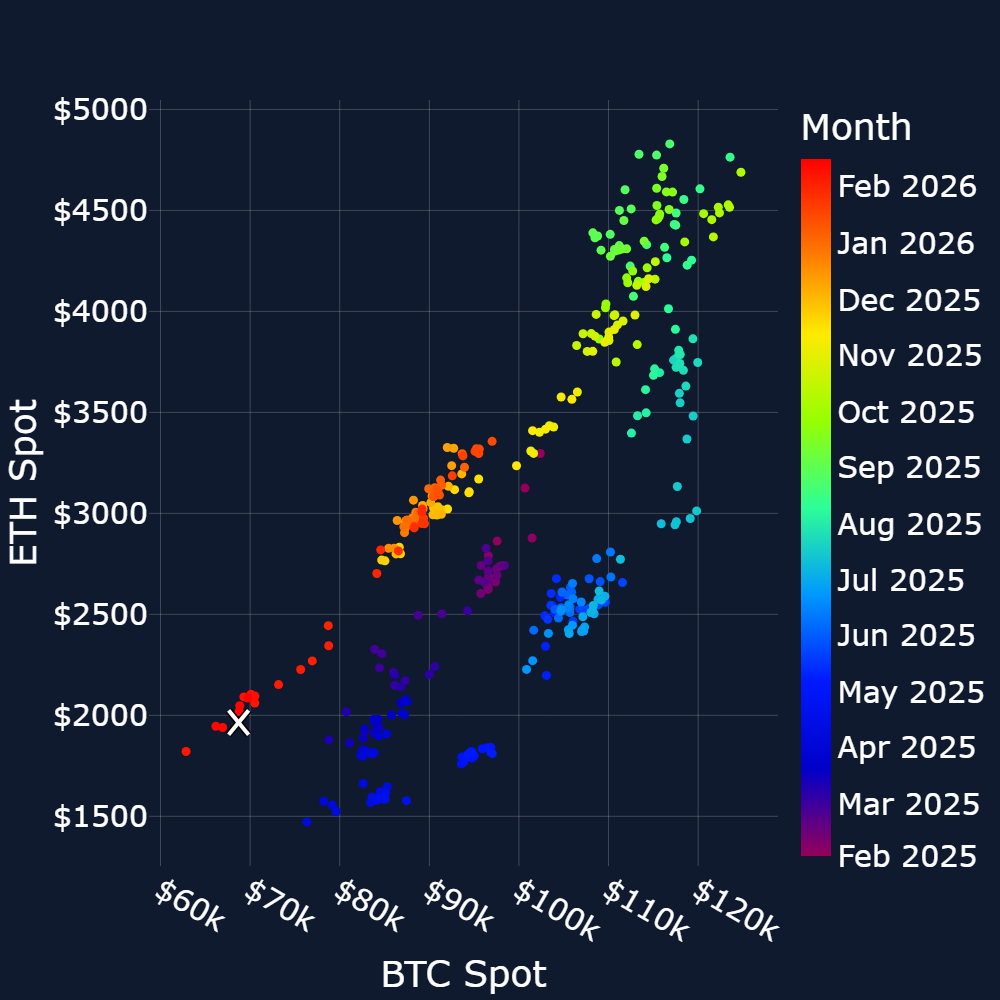

ETH Spot vs BTC Spot regression

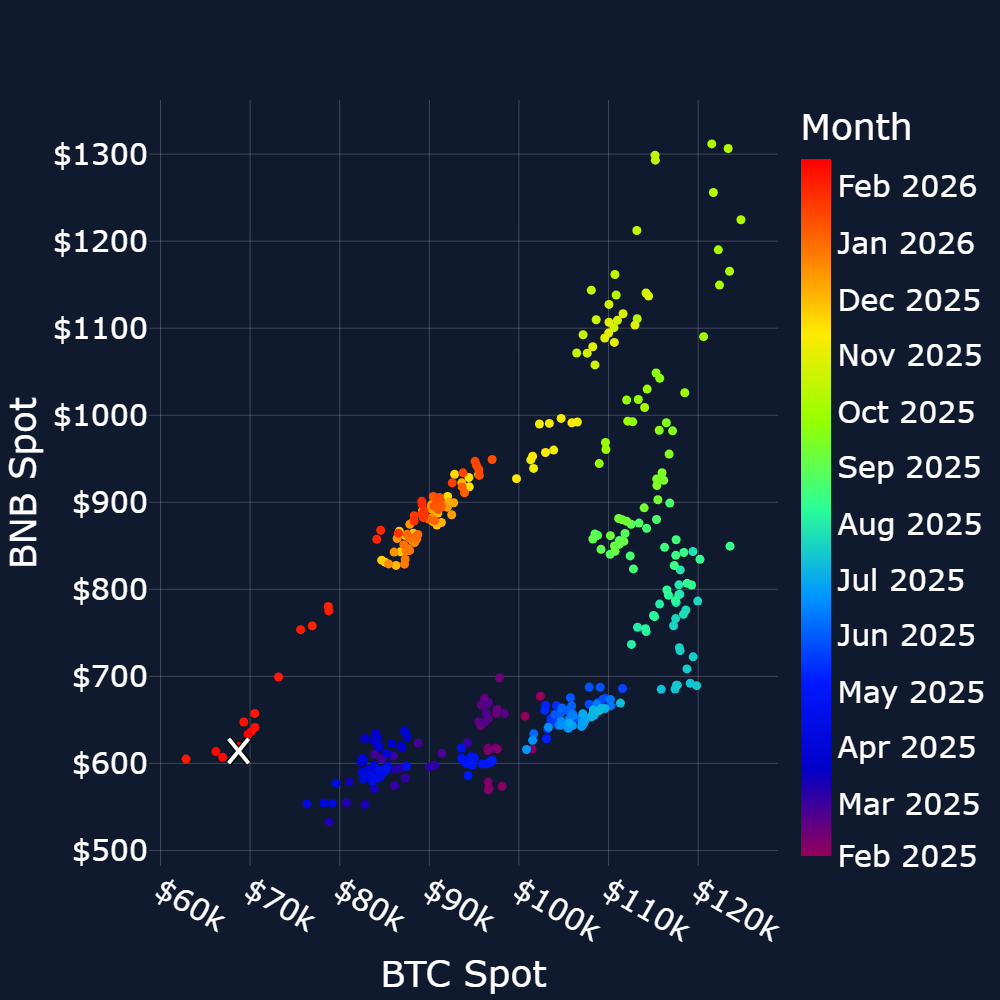

BNB Spot vs BTC Spot regression

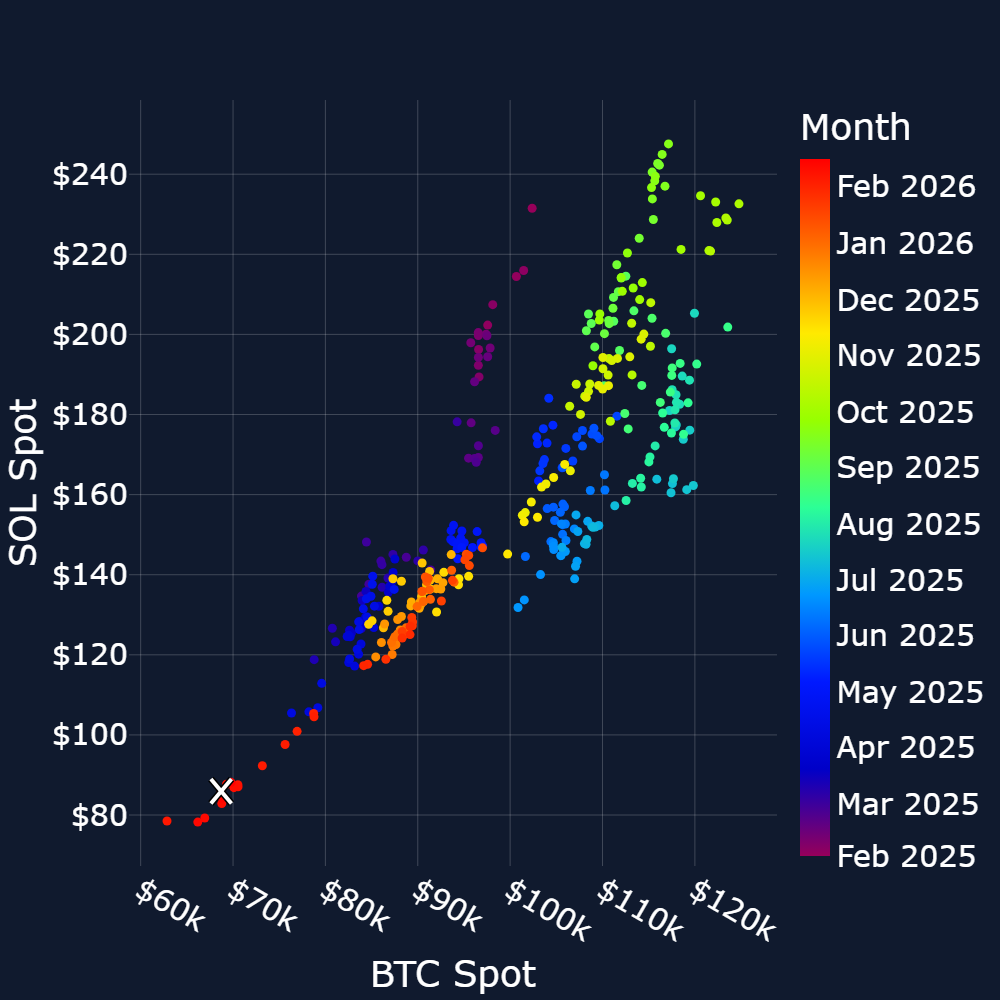

SOL Spot vs BTC Spot regression

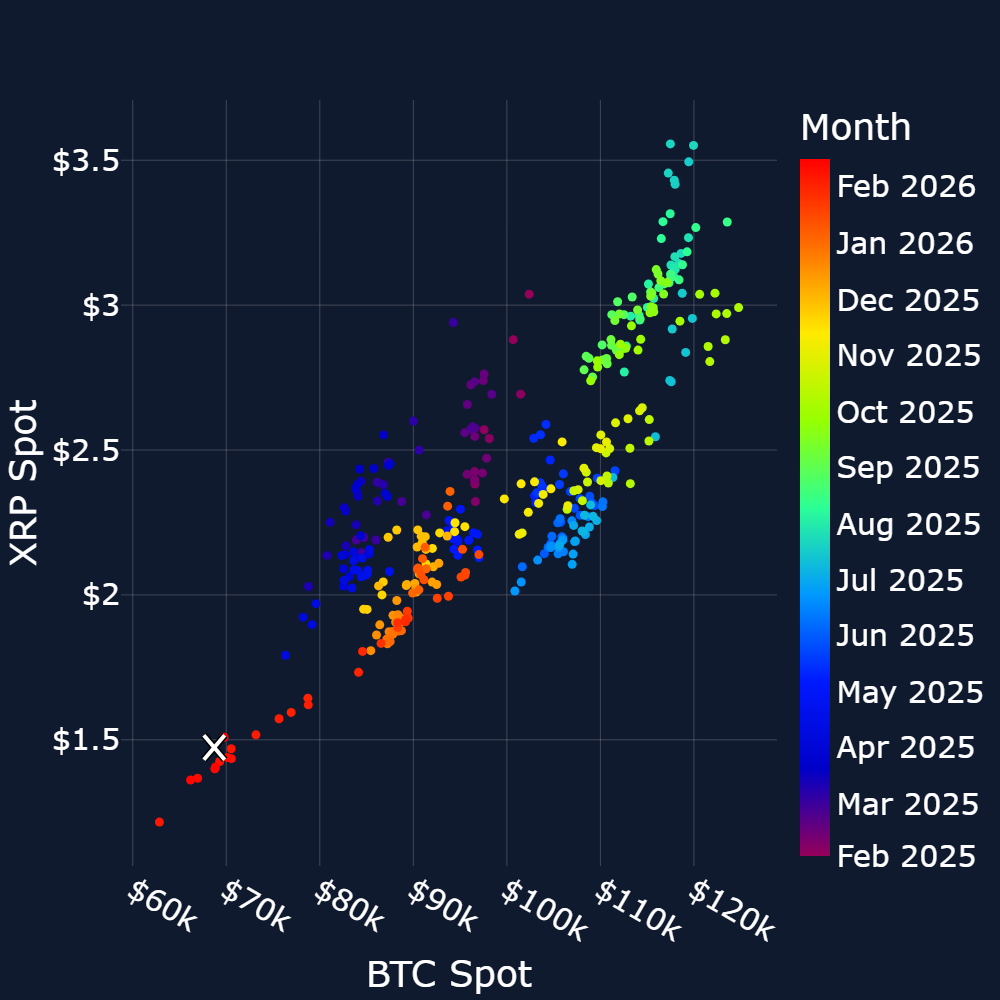

XRP Spot vs BTC Spot regression

Risk Appetite Index

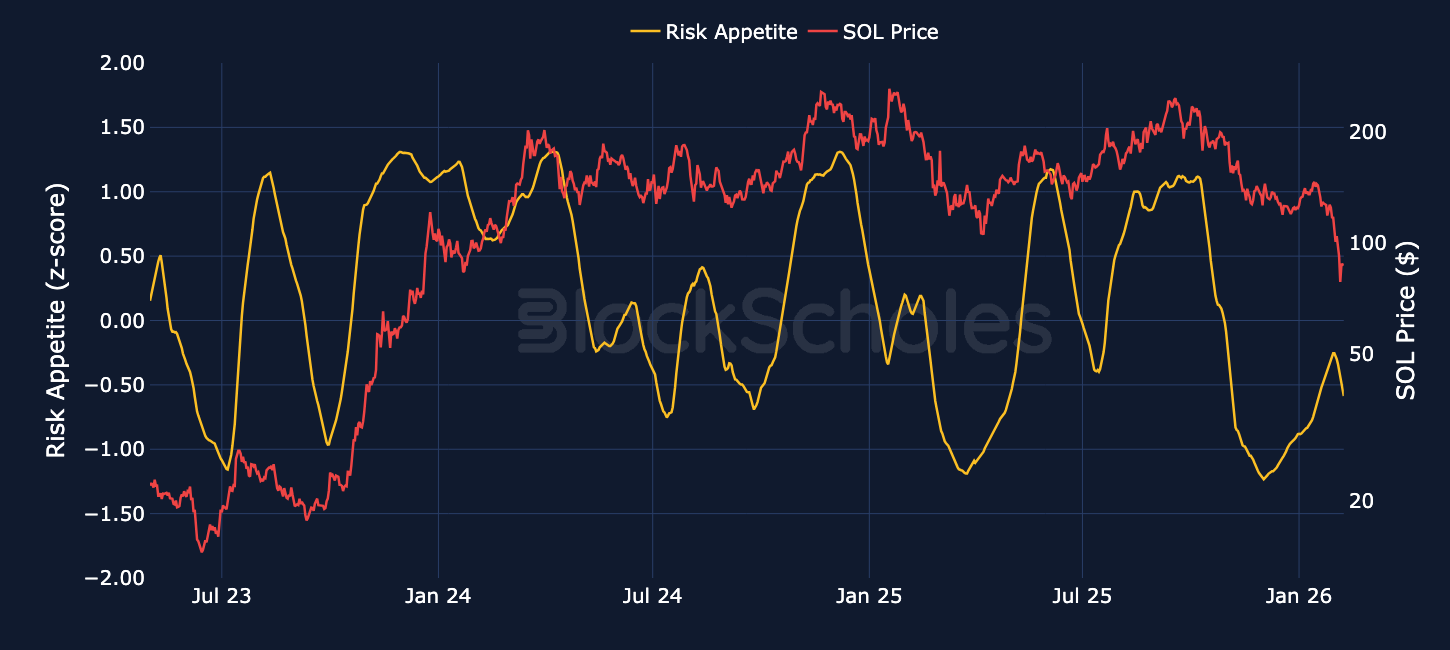

Risk Appetite Index - SOL

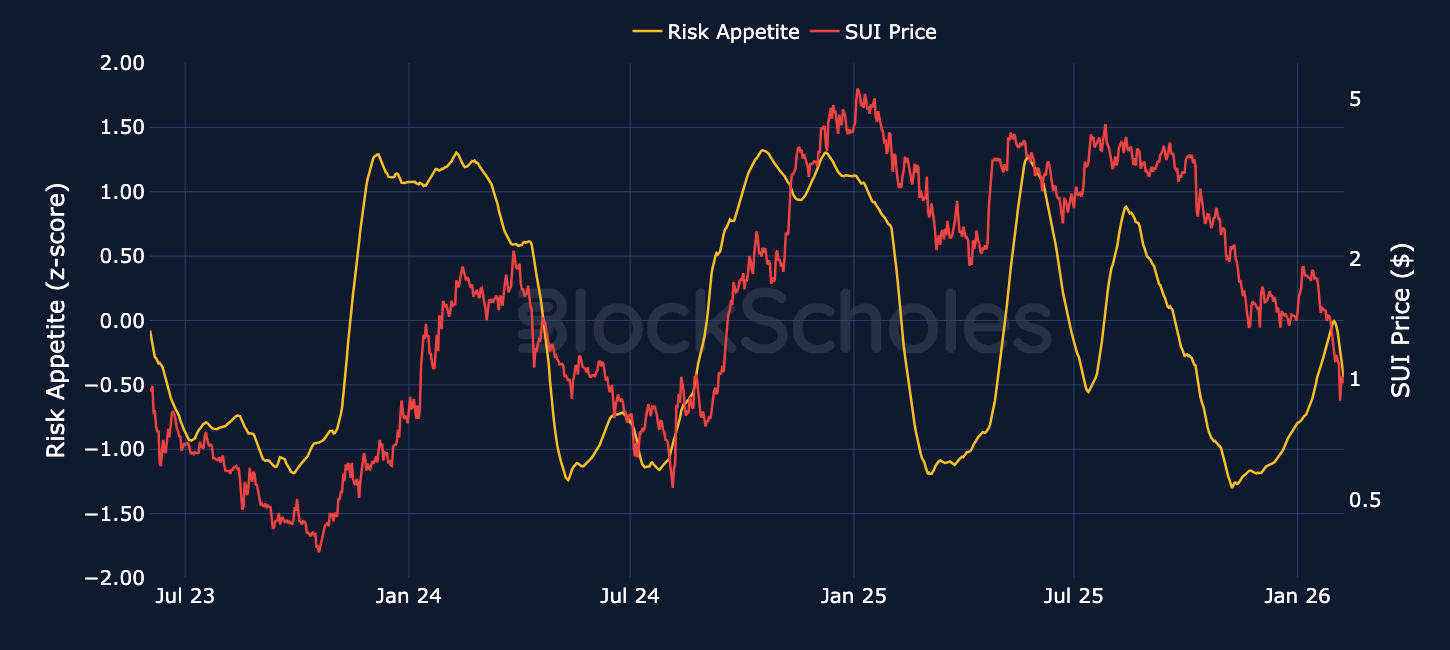

Risk Appetite Index - SUI

Block Scholes’ Risk Appetite Index measures the level of euphoria (above 1) or panic (below -1) in the spot market. Momentum in this index shows a strong relationship to spot returns.